CFIB says the cost of doing business has gone "through the roof."

A Canadian small business group is calling on the federal and provincial governments to temporarily eliminate or lower fuel taxes.

The Canadian Federation of Independent Business says record gas prices, supply chain issues and labour shortages have pushed the cost of doing business through the roof.

The group is calling on provincial and federal levels of government to temporarily eliminate or lower fuel excise taxes.

It also also recommends pausing planned hikes to carbon taxes and raising the federal and provincial small business deduction threshold to $600,000 to match Saskatchewan.

"Every cent counts for small businesses, especially as they navigate skyrocketing input costs and labour and product shortages. Three provinces - Ontario, Alberta, and Newfoundland and Labrador - have provided temporary relief at the pumps - now the federal and other provincial governments need to follow their lead," said Corinne Pohlmann, Senior Vice-President of National Affairs at CFIB. "More than half of small businesses nationwide have yet to return to normal revenue levels. As the premiers come together today and tomorrow, they need to make small business recovery a top priority."

The group says higher transportation and fuel costs have driven about 92 percent of small businesses to raise prices within the last year.

Niagara Man Charged with Child Luring

Niagara Man Charged with Child Luring

St. Catharines Trying for Development Near Hospital

St. Catharines Trying for Development Near Hospital

NRP Release Robbery Suspects Pics

NRP Release Robbery Suspects Pics

Update: Police Charge Another Man, Other Charges Dropped

Update: Police Charge Another Man, Other Charges Dropped

Speed Cameras Considered Near Schools

Speed Cameras Considered Near Schools

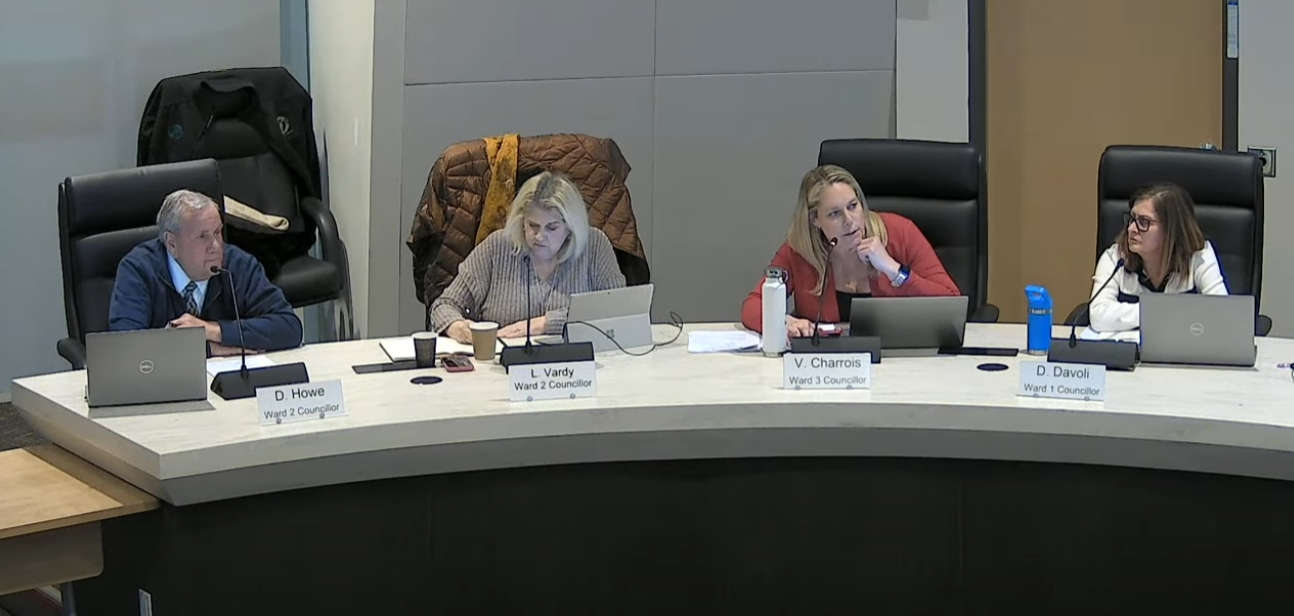

Grimsby Council Pay Reviewed

Grimsby Council Pay Reviewed

NRP Find Missing Senior

NRP Find Missing Senior

Update: Suspect Wanted for Murder

Update: Suspect Wanted for Murder