Canadians who received emergency benefits will have some supports at tax time.

Prime Minister Justin Trudeau announced today that people who received emergency funds and made up to $75,000 in taxable income won't have to pay interest on 2020 tax debt until next year.

Additionally, anyone who applied for the Canada Emergency Response Benefit based on gross income instead of net income will not be required to repay the benefit, as long as they are eligible for it.

Trudeau also announced new measures for anyone entering Canada by car.

He said that effective February 15th, anyone entering Canada by vehicle will need to show proof of a negative COVID-19 test.

The test must have been taken within 72 hours of entry into the country.

NRP Searching for B&E Suspects

NRP Searching for B&E Suspects

Welland CAO Optimistic for 2026

Welland CAO Optimistic for 2026

Niagara Clinics Help Coughs, Colds

Niagara Clinics Help Coughs, Colds

Clifton Hill Construction in January

Clifton Hill Construction in January

Gas Prices to Hold Steady: Analyst

Gas Prices to Hold Steady: Analyst

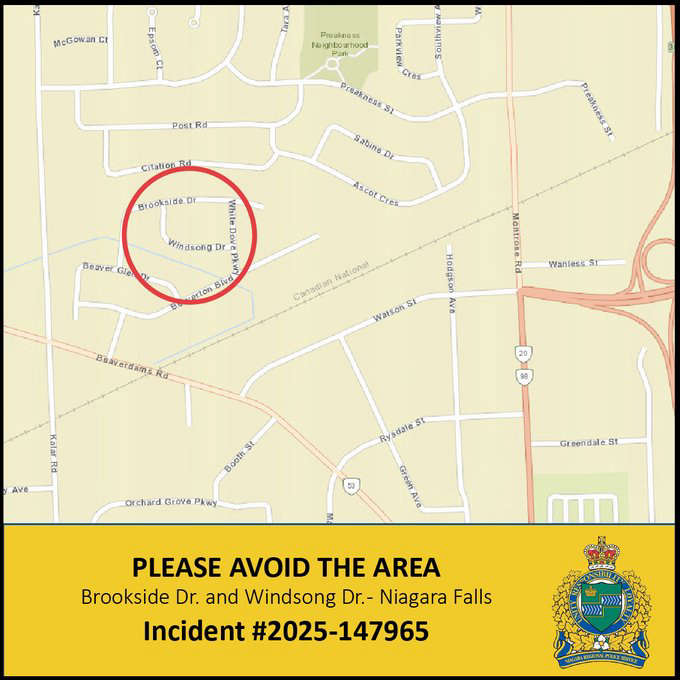

NRP Using Warrant in Niagara Falls Area

NRP Using Warrant in Niagara Falls Area

Part of Welland Canal Officially Named

Part of Welland Canal Officially Named

Girl Assaulted in Break and Enter

Girl Assaulted in Break and Enter